Why Buying an Emerging Markets ETF is a Bad Idea

Countless times, clients have told us they’re “already investing in emerging markets!” because they bought into a mass market ETF or mutual fund from Vanguard or iShares.

Don’t get us wrong: we aren’t saying these emerging market ETFs won’t go up in value over time or that you shouldn’t buy them.

But it’s worth addressing a common error that many people make when investing overseas.

See, most investors purchase shares in an emerging markets ETF, or a similar mutual fund, for two different reasons.

The first reason why people invest in emerging markets is simply to diversify their portfolio. Not having to rely on the performance of a single market or currency can limit your overall downside.

Meanwhile, the second reason is to achieve higher returns. Emerging markets are called such for a reason – they’re normally growing faster compared with developed economies and are, well, emerging.

Here’s the issue though: a typical emerging markets ETF or fund that your brokerage tries selling you won’t accomplish either of those things.

Quite frankly, you aren’t investing in emerging markets correctly if you’re doing it through an ETF or mutual fund.

Let’s explore the risks of emerging market ETFs, and uncover why these funds don’t invest emerging economies the right way.

You Aren’t Even Investing in Emerging Markets

A large percentage of stocks owned by emerging market ETFs and funds aren’t even located in emerging markets.

You read that right: emerging markets funds don’t even invest in their namesake. At least, not nearly as much as they should.

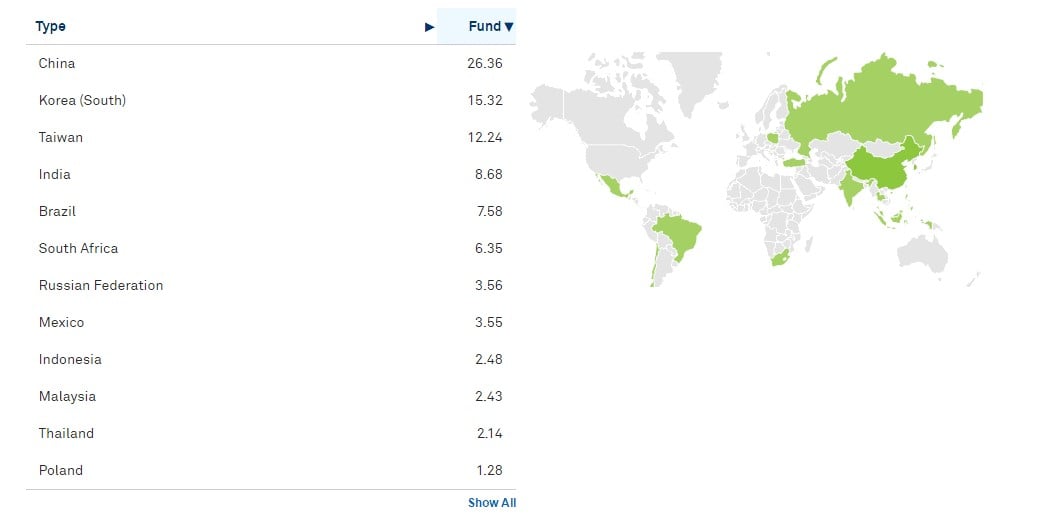

Simply look below at the holdings of the iShares MSCI Emerging Markets ETF. This is the largest Emerging Market ETF on the planet with over US$30 billion dollars under management.

However, two out of the top three nations they invest in are South Korea and Taiwan, together which account for more than 25% of the fund’s total assets.

South Korea and Taiwan are developed nations by any possible metric. Each of them boasts a GDP per capita exceeding that of New Zealand, Israel, or Italy’s.

Rather an “Emerging Markets ETF”, this fund should probably be called a “China and Developed Asia ETF”. Half its holdings are from China, South Korea, and Taiwan!

Other funds, such as Vanguard’s FTSE Emerging Markets ETF, don’t fare much better. They are big fans of Taiwan for some reason.

Yet more bizarre is that this fund has exposure to the United Arab Emirates and Qatar – two of the richest nations on the whole planet.

Emerging Markets Won’t Meet Your Goal in the First Place

Generally speaking, it’s a good idea to spread your portfolio across several currencies and jurisdictions.

Merely ask anyone holding British Pounds who saw their net worth, in terms of most other top global currencies, decline by around 20% because of Brexit’s impact.

While emerging market ETFs and mutual funds can indeed help you invest in other currencies, they fall short when it comes to avoiding financial crises altogether.

In fact, most emerging economies fared even worse than the United States and Europe during the 2008 Global Recession.

Why is that? Although emerging market economies are fundamentally different from those in the developed world, they’re still dependent on wealthier nations for growth.

Our planet is now interconnected. 7-Eleven and Starbucks can be found in almost every corner of the globe. Therefore, emerging economies rely on continued investment from multinational firms to fuel their own growth.

But when the US, EU, or China enters a recession, investment from large multinationals stops flowing in.

The result is that emerging markets also enter a decline – sometimes an even worse one compared with developed economies. Indeed, it’s a major risk of investing in emerging markets.

Frontier Markets Might Be Your Answer

If you truly want to grow and preserve your wealth, you may want to invest in frontier markets. Such rapidly growing countries have a history of skipping global crises altogether.

Cambodia, for example, only had a single year of negative GDP growth in the past three decades. Other frontier markets like Mongolia and Kenya enjoy a similar performance.

These places don’t need to worry about McDonald’s cutting back on expansion since they don’t even have McDonald’s in the first place.

When these large multinationals do inevitably arrive, the extra investment will surely boost their economic growth even further though.

In short: an emerging market ETF won’t help you avoid recession. Yet frontier markets can.

FAQs: Emerging Market ETFs

K

L

Why Don’t Emerging Markets ETFs Truly Invest in Emerging Markets?

Many so-called “emerging markets” ETFs allocate a significant portion of their funds to countries that are actually developed economies.

For example, the iShares MSCI Emerging Markets ETF, one of the largest in the world, invests heavily in South Korea and Taiwan, both of which have GDP per capita levels higher than some European nations.

Additionally, some funds even include the United Arab Emirates and Qatar, two of the richest countries globally. This means that investors looking for true emerging market exposure may not be getting what they expect.

K

L

Do Emerging Markets ETFs Help Diversify a Portfolio?

Not as much as investors might think. While these ETFs do provide exposure to different currencies, they do not necessarily protect against global financial crises. Many emerging markets remain highly dependent on investment from developed economies.

When a major economy like the U.S., the EU, or China enters a recession, capital inflows into emerging markets slow down, often causing an even greater downturn in these economies. This interconnectedness means that emerging markets ETFs may not offer the diversification benefits that investors seek.

K

L

What’s a Better Alternative to Emerging Market Mutual Funds and ETFs?

For investors looking for higher growth and better diversification, frontier markets may be a better option. Countries like Cambodia, Mongolia, and Kenya have historically been less affected by global recessions.

Since these economies are still in the early stages of development, they are less reliant on multinational corporations and global capital flows, making them more resilient during economic downturns.

K

L

Should I Completely Avoid Emerging Markets ETFs?

Not necessarily. Emerging markets ETFs can still provide some exposure to fast-growing economies, and they may increase in value over time. However, investors should be aware that these funds do not always invest in true emerging markets and may not offer the diversification or growth potential they expect.

Those seeking higher returns and better protection against global downturns should consider direct investments in frontier markets or other asset classes that are less correlated with the global economy.

Frontier Market Stocks: Consider These Countries

Last updated September 2nd, 2025

In most countries, stocks are the most common method of offshore investment by far.

Compared to actively managing rentals or a business, it’s way easier to just place a trade with your broker and be done with it.

With that said, frontier markets often don’t even have a stock market at all.

Frontier markets are on a rapid growth trajectory, but often aren’t developed enough to the point where they’ve built up the infrastructure required for a public equity market.

That’s not necessarily a bad thing. In fact, it’s part of the appeal of investing in frontier markets. Greater opportunities exist in places that aren’t yet swarmed by capital from BlackRock and other institutional investors.

Below, we’ll explore several frontier markets in Asia that do have fully-functioning stock exchanges that you can invest in as a foreigner.

They may still require travel to personally visit a branch and open a brokerage account. Regardless, a determined investor can benefit from entry barriers.

Stocks in Mongolia

Positioned directly to China’s northern border, Mongolia is getting tons of investment from its much bigger neighbor.

Mongolia isn’t a small country itself in terms of land size – it’s the world’s 18th largest. Having barely over 3 million inhabitants gives it one of the lowest population densities on the planet though.

Chinese investors are pouring into Mongolian investments because of this fact, combined with its vast reserves of coal, tin, oil, and other natural resources.

Simply put, Beijing needs a greater share of Mongolia’s resources as they deplete their own.

Out of all the frontier market exchanges we cover, stocks in Mongolia are the least correlated with assets in Europe and the Americas.

Easy access to hot money across the border is possibly why Mongolia has a fairly sizable stock exchange… at least for a frontier market.

You can trade nearly 200 publicly listed companies on the Mongolia Stock Exchange (MSE) ranging across almost every sector.

However, you’ll need to open a local brokerage account to buy stocks in Mongolia. There’s no other way around this. A few businesses do offer remote brokerage account opening services though.

Stocks in Vietnam

Vietnam arguably isn’t even a frontier market anymore. All of the major rating agencies consider it one though, so we’re still including Vietnam on our list.

The Southeast Asian nation is unique because it has two different stock exchanges. Both its capital of Hanoi and largest city of Saigon each have an exchange with several hundred listed firms.

You’ll generally need to open a brokerage account in Vietnam in order to trade stocks directly. Either that, or a trade through an account based in a nearby financial hub such as Singapore.

No brokerage that’s based in Europe or the US provides access to Vietnamese stocks. Nor any other frontier market, for that matter.

The bad news? You’ll need to visit Vietnam to open a local brokerage account and can’t do it from home.

If opening a local account is too inconvenient for you, it’s possible to buy frontier market ETFs based in other countries focus which exclusively on Vietnamese stocks.

A majority of these ETFs are listed on U.S. exchanges and include VanEck Vectors Vietnam. However, a frontier market ETF isn’t the best way to buy stocks in Vietnam. It’s not the most cost-effective either.

Instead, you should ideally look towards small and mid-cap stocks. There are dozens of smaller firms in Vietnam that barely see analyst coverage.

Plenty of undiscovered gems wait for anyone able to put forth the effort. That’s generally how things work in Asia’s emerging economies.

More Frontier Markets: Cambodia, Laos & Myanmar

It’s worth mentioning that some frontier markets in Asia, while they do technically have a stock exchange, are in a position of low trading volume or liquidity.

Either that, or they simply aren’t accessible to foreign buyers at all right now.

Cambodia’s stock market, for example, has precisely eleven listed companies. Five of those are quasi-public corporations including the Phnom Penh Water Supply Authority and Sihanoukville Autonomous Port.

Next door, stocks in Laos are in a similar position. The Lao Securities Exchange likewise has eleven listed which include the nation’s largest bank and two property developers.

The Yangon Stock Exchange in Myanmar is the world’s smallest with just four listed companies. It’s also the newest stock exchange in Asia. But few available options and lack of foreign buyers hindered its momentum.

That was even before a coup. Needless to say, buying stocks in Myanmar as a foreigner is practically impossible nowadays.

Here’s the main question: can these frontier markets attract a greater number of listings and lure foreign investors?

So far, Cambodia’s stock exchange is steadily growing over time. Laos is stagnant while Myanmar’s is collapsing.

Time will tell how Asia’s frontier market stock exchanges will perform over the long-term.

We think several of these frontier market stock exchanges, although perhaps not all, will see immense growth in terms of both market cap and profitability in the coming decades.

Frontier Market Stocks: FAQs

K

L

What’s a Frontier Market?

Frontier markets refer to economies that are less developed compared to emerging markets. These economies are not large or prosperous enough to be classified as emerging markets.

Typically, frontier markets are experiencing rapid economic growth. This is often driven by demographic factors such as population expansion, urbanization, the emergence of a new middle class, and increasing foreign investment.

Some examples of frontier markets include Laos, Cambodia, and Nepal.

While frontier markets have the potential for rapid economic growth, investing in them involves a certain degree of risk. Many frontier markets either lack a stock exchange altogether, or have a small one that is challenging to access.

K

L

How Can I Trade Stocks in Frontier Markets?

Opening an brokerage account in Singapore will give you access to some frontier market stocks in Asia. You’ll be able to trade in Indonesia, Philippines, and Vietnam through an offshore account based in one of Asia’s financial hubs.

However, it’s worth noting that the vast majority of frontier market stock exchanges require a local account in order to access them. These countries usually haven’t developed to the point where they’re accessible from abroad.

K

L

What’s the Smallest Stock Exchange in the World?

Cambodia and Laos both have only eleven stocks listed on their exchange, which makes them both tie for the world’s smallest stock market.

K

L

How Are Emerging Markets and Frontier Markets Different?

The key differences between emerging markets and frontier markets lie in their size, level of economic development, and risk profile.

Emerging markets are generally larger and more developed economies compared to frontier markets. These nations typically have more established stock markets which makes them more accessible.

In contrast, frontier markets are smaller and less mature, often lacking the robust financial infrastructure found in emerging economies. As a result, frontier market stock exchanges tend to be smaller and more challenging to access.

This disparity in development also translates to differing risk profiles. Emerging markets are generally viewed as lower-risk investment destinations. Frontier markets, on the other hand, are considered riskier in general.

However, this increased risk also brings the potential for higher returns, as frontier markets often experience rapid growth driven by factors like population expansion, urbanization, and rising foreign investment.